Ratibi Card Salary Check Online – PPC Balance Inquiry

Ratibi Card is a game-changing payment system specially designed for employees earning a monthly salary of 5,000 AED or below. The best thing about Ratibi Card is that you don’t need to have a bank account in order to use it. Your salaries will be directly deposited to your Ratibi card, and no matter where you are, you can use your card at any atm to withdraw money. So, you might be looking for a way to check your salary. Today, we’ll walk you through how you can do a Ratibi Card Salary Check and what its benefits are.

So, are you ready? Let’s dive into the exploration of the Ratibi world along with the Ratibi Card Salary Check procedure.

How To Check Ratibi Card Salary Check Online?

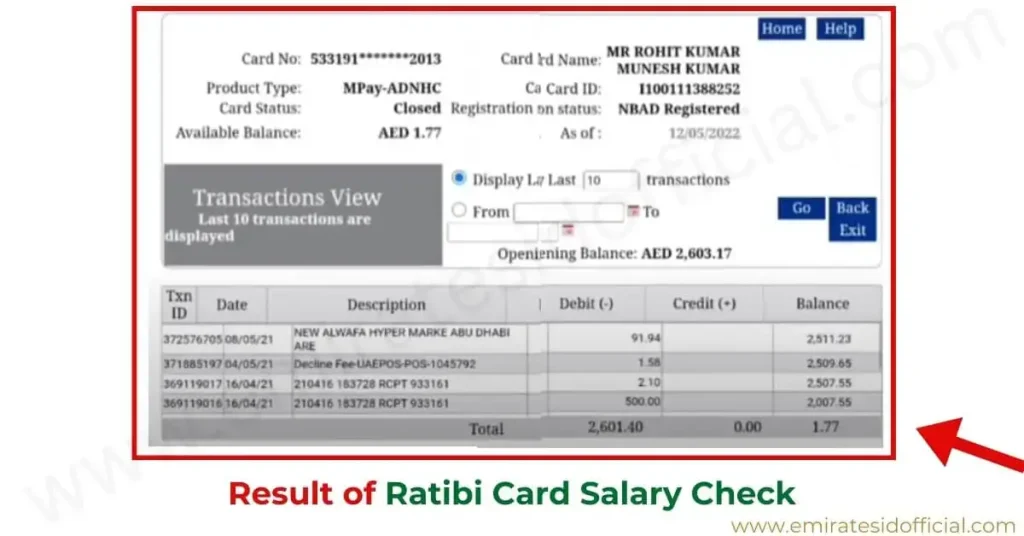

You can check your Ratibi prepaid card inquiry through Ratibi Card Salary Check guide by following the steps below:

That’s how you can do your Ratibi salary checking in just a few moments through Ratibi Card Salary Check guide. If you’re an NBAD card user, you can check your salary at Salary Check NBAD Inquiry.

Note: You must enter your card details correctly, as you won’t be able to check your salary status if you enter the information wrong.

In case you face any difficulties, you can contact Ratibi’s Customer Support at 600522298. Also, you can update your Emirates ID in your Etisalat account at Update Emirates ID in Etisalat – Guide.

Benefits of Raibi Card

So, you must be thinking about why you should use the Ratibi Card. A complete list of all the benefits that the Ratibi Card offers is listed below.

Basic Benefits

Looking for a job in Dubai? Explore how you can get your dream job by exploring the proven tips at How To Get a Job in Dubai.

Insurance Benefits

Safety and Convenience Benefits

Explore how you can get a work visa at UAE Work Visa – Guide.

Employer Benefits

Ratibi Card’s Eligibility Criteria

The eligibility criteria for the Ratibi Card have been mentioned below:

Now, you can easily renew your ID card at Emirates ID Renewal.

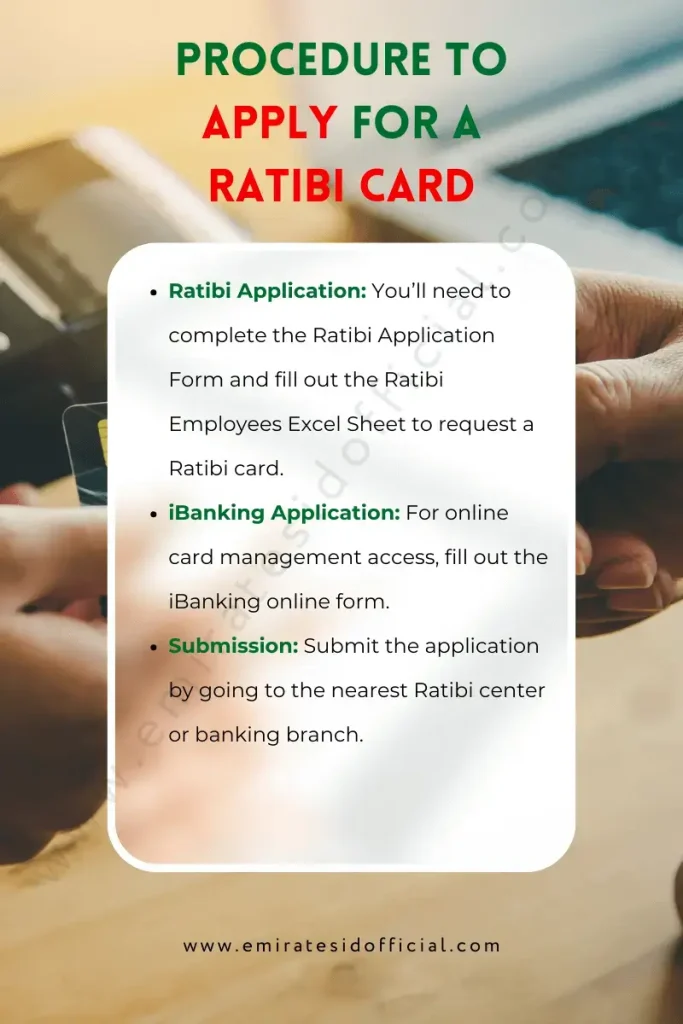

How To Apply for a Ratibi Card?

So, you must be thinking about how you can apply for the Ratibi Card. A complete procedure has been provided below:

So, that’s how you can apply for a Ratibi Card.

In case you lost your ID card, you can find the solution on what to do at the Lost Emirates ID Card Guide.

FAQs

Wrapping Up

A complete procedure for Ratibi Card Salary Check has been explained above. Now, you can check your salaries by following the above procedure. Make sure to follow the above process carefully, and while entering your details, ensure that you’re entering the data correctly, as only then will you be able to see your Ratibi Card Balance.

Ratibi card is an all-in-one card that benefits not only the employees but also the employers. So, whenever you need to check your Ratibi salaries you can visit the Ratibi Card Salary Check Guide at emiratesidofficial.com