Check Your UAE Credit Score In Just 6 Steps: A Complete Guide

While living in UAE, you might need to get a loan to start a business or for other needs. So, your credit score is crucial in getting a loan. The better your credit score, the higher your chances will be in getting a higher amount of loan. So, you might ask how I can check my UAE Credit Score. Today, we’ll walk you through a complete guide through which you can check your credit score in UAE. A complete list of how you can improve your credit score has also been shared below.

Let’s get started.

What Is Meant By A Credit Score?

Credit Score represents your financial ability to pay your debts. It comprises of three digits. Banks and other financial institutions grant you loans and other financial products by measuring your credit score. A higher credit score indicates your creditworthiness.

Want to apply for the tourist visa? Find out you can apply for it at Dubai Tourist Visa.

What Is A Good Credit Score?

A good credit score in UAE ranges from 680-730. Normally, any credit score above 700 is considered good, and any credit score below 300 is considered dangerous.

Having a good credit score can help you get loans and other financial advantages from banks easily, and in case if you have a credit score below 300, then it’s more likely that you might not be able to get a loan from the bank.

So, in order to get a higher loan, you must have a credit score of 700 or above.

Explore how to get a job in Dubai using these 10 secrets.

How My UAE Credit Score Is Calculated?

You might be thinking, how my credit score in UAE is calculated? Al Etihad Credit Bureau (AECB), a UAE government-based company, calculates your credit score.

AECB collects the history of all the payments, including bill payments, loan payments, mortgages, credit card payments, and other factors of all the individuals and companies, and issues a credit score based on all the factors. It has been serving credit reports since 2014.

It’s worth noting that companies’ and individuals’ credit scores may vary depending upon their habit of paying their bills and other stuff on time from time to time.

Explore, How to check your medical insurance status using Emirates ID.

How Can I Check My UAE Credit Score?

You can check your credit score easily, both online and offline.

1. Checking your UAE Credit Score Through The AECB Website

You can easily check your credit score online through the AECB website. Follow the steps below to get started.

Now, you can easily check your UAE Visa Status Validity using your Passport only.

2. Checking your Credit Score Through The AECB App

You can also check your UAE credit score using the AECB App. Follow the steps below to get started.

Find out how to apply for Emirates ID Renewal.

3. Checking your UAE Credit Score Through The AECB Branches

You can also check your credit score by visiting AECB branches. Visit any AECB Branch, provide them with your Passport Copy, Emirates ID, and Valid Email Address, and ask them to check your Credit Score. They’ll check your Credit Score and will also provide you with a report. Please note that the charges for checking your Credit Score and getting a report differ.

Also, find out about the UAE Labour Card if you’re going to shift to UAE.

Cost of Checking Your Credit Score in UAE

There are different charges for checking your credit score in UAE for individuals and companies. Let’s have a look at them.

For Companies

The charges for companies are mentioned below:

For Individuals

The charges for individuals are mentioned below:

Requirements for Checking Your Credit Score

In order to check your credit score in the UAE, you’ll need the following documents:

Requirements for Companies

If you’re a company, you’ll need to provide the following documents:

Requirements for Individuals

If you’re an individual, you’ll need to provide the following documents:

Now, you can easily check your Emirates ID fines at Emirates ID Fine Check.

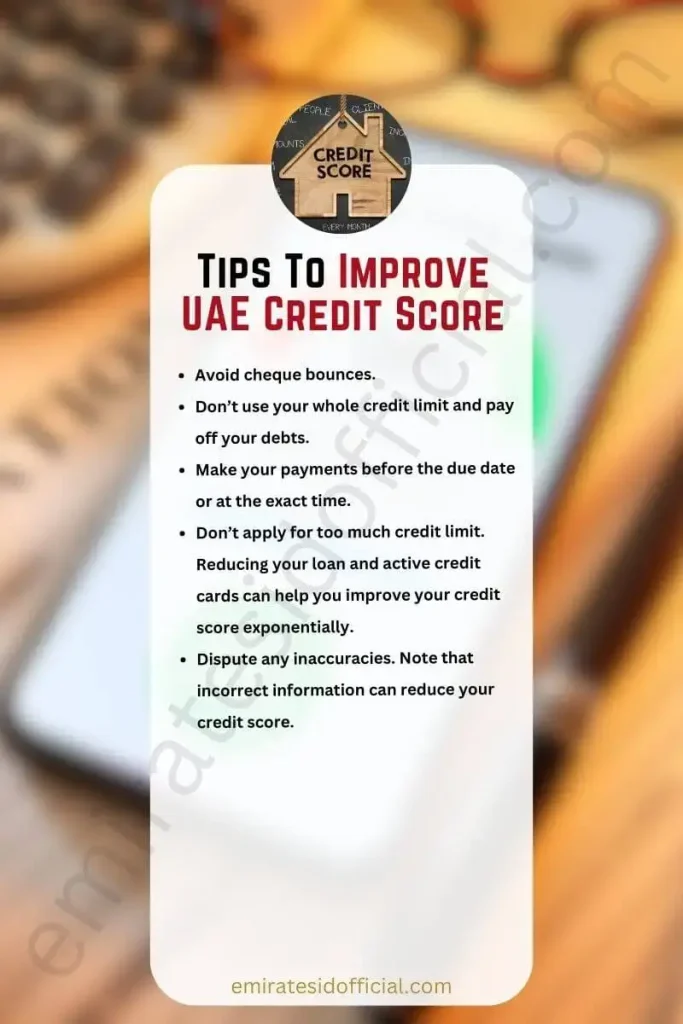

Tips on How To Improve Credit Scores in UAE

You might ask, “How can I Improve My Credit Score in UAE?” Look at the tips below that can help you improve your credit score.

FAQs

Summary

A complete guide on UAE Credit Scores has been shared above, along with the methods through which you can check your credit score in UAE, its requirements, and fees and tips have also been shared above through which you can improve your credit score. You can follow the above-mentioned guide to check your credit score and how much it’ll cost you.